Subsequent to hitting lows of $48k throughout the end of the week, Bitcoin (BTC) has taken off to $54.3k at the hour of composing, as per CoinMarketCap.

Bitcoin appropriation in Asia is accepting another turn as more institutional financial backers are joining the organization, as recognized by Joseph Young. The crypto examiner clarified:

“The biggest gaming company in South Korea, Nexon, bought $100 million worth of Bitcoin. Nexon also bought Bitstamp and Korbit, two major exchanges in Europe and South Korea, in the past three years. This is a big step forward for institutional BTC adoption in Asia.”

Prior on, Young had uncovered that crypto premium in Asia was preparing, which showed long haul hopefulness on the lookout.

Nexon Co. joins a developing rundown of worldwide tech organizations accepting Bitcoin, similar to American electric carmaker Tesla. The internet game supplier purchased 1,717 BTC, what broke the record as the biggest at any point acquisition of digital currency by an organization exchanged Tokyo.

In February, Tesla procured Bitcoin worth $1.5 billion, and after a month, the organization’s CEO Elon Musk uncovered that clients could purchase vehicles utilizing BTC.

Bitcoin’s flood is required to proceed

Bitcoin has been in a solidification state since the time it hit an untouched high above $64k as of late. The top cryptographic money plunged to lows of $48.5k throughout the end of the week as theories about the U.S. President Joe Biden’s organization expanding capital additions charges became the overwhelming focus in the crypto space.

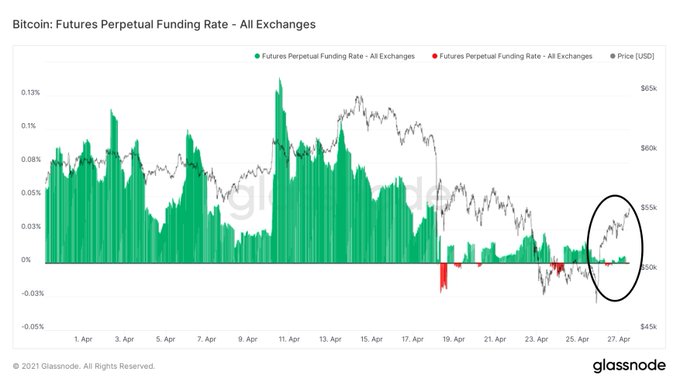

In any case, Yann and Jan, the prime supporters of driving on-chain measurements supplier Glassnode, accept that BTC’s flood is relentless. They clarified:

“With all that frictious leverage wiped out of the system Bitcoin is unstoppable.”

Bloomberg’s senior ware planner, Mike McGlone, accepts that there are sufficient impetuses encompassing BTC that can without much of a stretch push its cost to $100,000. For example, the insight that Bitcoin is a choice to cash and the developing number of proposed Exchange Traded Fund benefits are essential for the center impetuses for the coin.

With Bitcoin’s exchange volume arriving at a month to month high of $4.45 billion, as suggested by Glassnode, the reality of the situation will become obvious eventually whether the top cryptographic money will hit a sticker price of $100,000 in 2021.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Blockchain News Site journalist was involved in the writing and production of this article.