Nearby trades presently have until July 11 to refresh their standards for posting tokens to be in consistence with SEC rules.

Thailand’s Securities and Exchange Commission has endorsed rules forbidding crypto trades in the country from supporting four distinct kinds of tokens in specific cases.

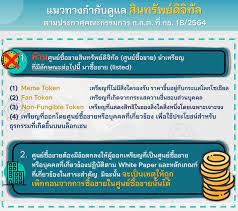

In a Friday declaration from the Thai SEC, the administrative body said that Secretary-General Ruenvadee Suwanmongkol had supported crypto trade rules, Notification 18/2564 on “Rules, Conditions and Procedures for Undertaking Digital Asset Business,” on Wednesday to become real. The new guidelines restrict Thai trades from dealing with image based tokens, fan-based tokens, nonfungible tokens (NFTs) and trade gave tokens.

For tokens gave by trades, the SEC said that any cryptographic forms of money needed to definitely adjust to the portrayals in their particular white papers just as any current rules for advanced resources. On the off chance that trades can’t meet these conditions, the administrative body said they would need to delist the token. As per the SEC, Thai trades have 30 days to refresh their standards for posting tokens to be in consistence with the new rules.

This adjustment of strategy would purportedly influence tokens including Dogecoin (DOGE), an image based cryptographic money whose cost has risen fundamentally since last year, just as Bitkub Coin (KUB), the local badge of the neighborhood crypto trade of a similar name.

Thailand’s Securities and Exchange Commission has given various rules and proclamations for singular merchants and crypto firms this year, once in a while with brutal reaction from general society. The administrative body proposed a 1 million baht — generally $32,000 — least yearly pay prerequisite for crypto interest in Thailand, and authorities have indicated that financial backers ought to be needed to go to a digital currency exchanging instructional class or breeze through an assessment to demonstrate their insight.

The Southeast Asian nation has had a confounded relationship with crypto for quite a long time. In February, Thailand’s travel industry board zeroed in on focusing on Japanese crypto holders, apparently with an end goal to resuscitate the business during the pandemic (numerous identities can’t enter the country without isolating.) However, the public authority has additionally proposed stricter Know Your Customer necessities in the nation, expecting trades to actually examine chips installed in Thai resident ID cards.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Blockchain News Site journalist was involved in the writing and production of this article.