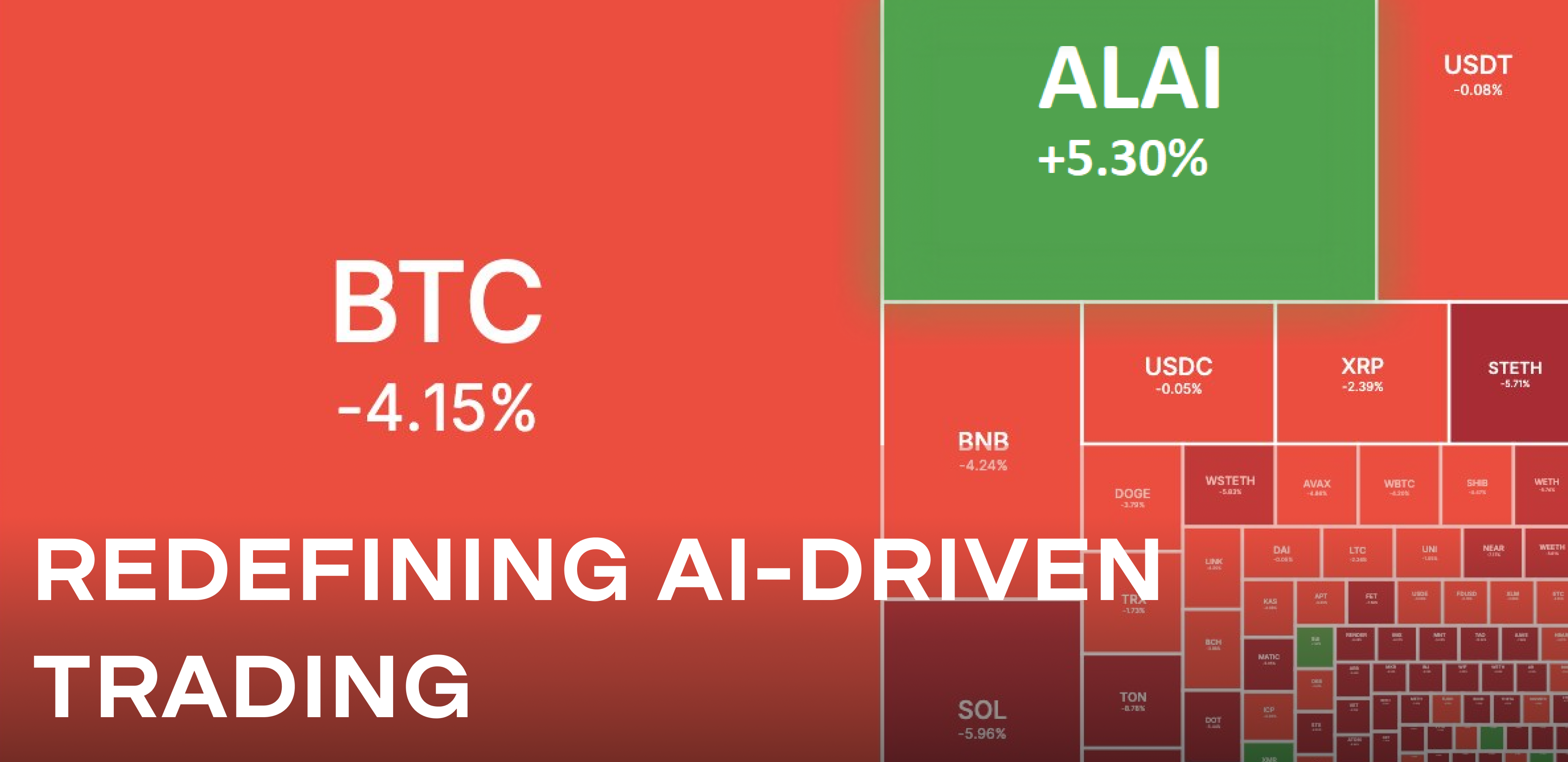

Porto, Portugal, 25th September 2024, ZEX PR WIRE, ALAI Network is introducing new approaches to AI-powered trading, offering innovative strategies in the cryptocurrency market. The platform employs advanced technologies to implement two key trading strategies, designed to maximize results while minimizing risks. This press release provides an in-depth look at the two core strategies used by ALAI Network.

Strategy 1: “AI Zoo” with a 58.8% Win Rate

At the heart of ALAI’s trading infrastructure is the system commonly referred to as the “AI Zoo”. This ensemble consists of over 120 independent machine learning models, each analyzing different aspects of the cryptocurrency market to provide a comprehensive overview of market trends and signals. Over nearly two years of development, this strategy has achieved a 58.8% win rate on the crypto market.

The AI Zoo stands apart from traditional algorithmic trading by using multiple models, each specialized in analyzing different data types, from price action to volatility. By combining the results from multiple algorithms, the system generates one consensus decision, minimizing trading risks.

Strategy 2: Multi-Pair Trading — 40% Monthly Growth

Another key strategy of ALAI is multi-pair trading. This strategy focuses on trading multiple asset pairs simultaneously, delivering 40% monthly returns, and is still in early battle-testing phase.

The multi-pair strategy capitalizes on short-term fluctuations across several markets at once, identifying entry and exit points based on real-time data. Trades are performed on a 4-minute trading graph and utilizes up to 32 trading pairs. The strategy reduces risk while increasing potential returns by diversifying assets. This structure allows ALAI to effectively use market volatility, regardless of broader market trends.

Real-Time Adaptation and Continuous Learning

One of the key features of the ALAI system is its ability to continuously learn from real-time data. Unlike many algorithmic trading systems that rely heavily on historical data, ALAI is always “in the moment,” adapting to current conditions. This prevents the system from being stuck on outdated data or trends, ensuring responsiveness to sudden market changes.

ALAI Network does not store its entire trading history and continuously re-trains itself on the most recent data to avoid over-reliance on historical data. This approach enables the system to remain efficient in dynamic market environments. An example of this adaptability is August 2024, a month of significant market volatility and downfall. Despite the fluctuations, our models were able to deliver solid 10.6% profit.

Profiting from Volatility, Not Trends

Another core feature of ALAI’s system is its focus on volatility, rather than global market trends. The system performs effectively by reacting to price changes, regardless of the market’s direction. This enables ALAI to remain profitable in any market condition—whether the market is rising, falling, or moving sideways.

Risk Management: Minimal Drawdowns

ALAI places a strong emphasis on risk management. Despite employing aggressive trading strategies, the system maintains a maximum drawdown of 8-9% per trading pair. Since at least 10+ trading pairs are active simultaneously, even in the case of a drawdown, the overall portfolio loss is limited to just 1%.

Additionally, ALAI operates without leverage, ensuring the system’s stability even during periods of high volatility. This conservative approach to risk allows the system to withstand market fluctuations while maintaining consistent performance.

The Token as an Entry Point to the System

The $ALAI token serves as the key to accessing ALAI Network’s trading system. It operates under a deflationary model, setting it apart from many other projects that rely heavily on token price speculation. The $ALAI token is not tied to market fluctuations; its primary value lies in the utility it provides by giving access to the platform’s features.

The token acts as the entry point to the system and determines the user’s participation in dividend payouts. This mechanism resembles traditional financial institutions, where dividends depend on the number of assets held.

Payout System and Classic Financial Principles

The ALAI payout system is based on the number of tokens held, directly impacting dividend distribution. This approach draws from traditional financial models, where the more assets an investor holds, the greater their participation in profit distribution. It also supports the platform’s deflationary model, incentivizing long-term token holders to increase their stakes.

Conclusion

ALAI Network implements innovative AI-powered trading strategies, combining the “AI Zoo” with multi-pair trading to achieve stable results. Thanks to real-time adaptation, risk management, and a transparent dividend system, ALAI offers a unique opportunity for those looking to participate in the modern cryptocurrency market, providing long-term value and stability in volatile conditions.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Blockchain News Site journalist was involved in the writing and production of this article.